If the issuer allows transfers to bank accounts, you should be able to do. The Visa card has a card number, expiration date and security code, just like a plastic card. Products not available in all states.īank deposit accounts, such as checking and savings, may be subject to approval. You can transfer your virtual Visa funds to your bank just like you would transfer them from a regular card. JPMS, CIA and JPMCB are affiliated companies under the common control of JPMorgan Chase & Co. Certain custody and other services are provided by JPMorgan Chase Bank, N.A. (CIA), a licensed insurance agency, doing business as Chase Insurance Agency Services, Inc. Insurance products are made available through Chase Insurance Agency, Inc.

Morgan Securities LLC (JPMS), a registered broker-dealer and investment adviser, member FINRA and SIPC. Morgan Wealth Management is a business of JPMorgan Chase & Co., which offers investment products and services through J.P. Past performance is not a guarantee of future results. Investing involves market risk, including possible loss of principal, and there is no guarantee that investment objectives will be achieved. "Chase Private Client" is the brand name for a banking and investment product and service offering, requiring a Chase Private Client Checking℠ account. is a wholly-owned subsidiary of JPMorgan Chase & Co. Easy.“Chase,” “JPMorgan,” “JPMorgan Chase,” the JPMorgan Chase logo and the Octagon Symbol are trademarks of JPMorgan Chase Bank, N.A. And if you don’t have the currency you need, let the card’s auto convert feature take over and convert your funds for the lowest available fee. Virtual cards can also be used for FNB Pay (Tap to Pay and Scan to Pay) and all partner wallet transactions, including Apple Pay, Google Pay, Samsung Pay.

#Virtual debit card free#

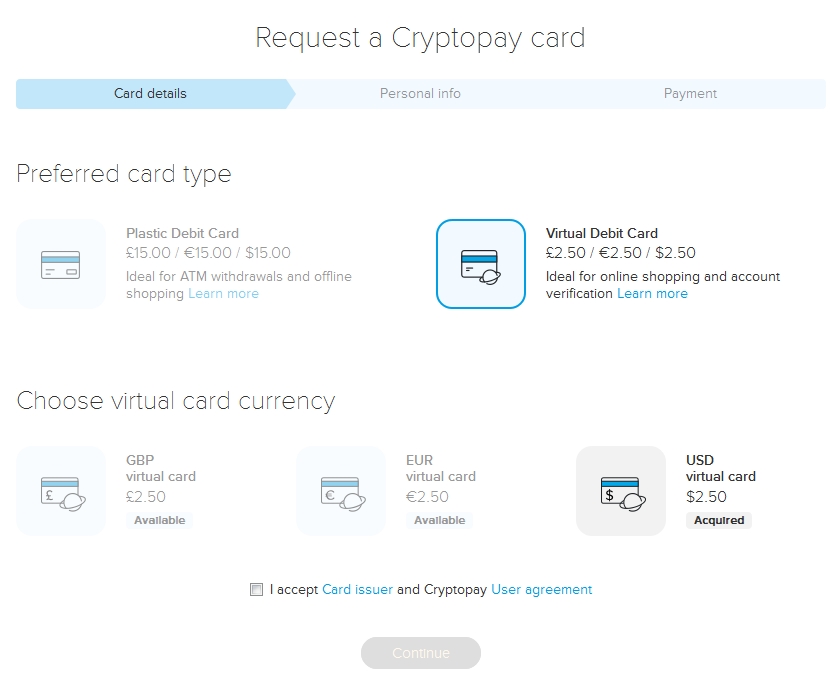

It’s free to spend any currency you hold, with no foreign transaction fee to worry about. There’s just a low, transparent fee from 0.41% to pay, with no ongoing costs or minimum balance. So why’s Wise the pick for international shoppers and travellers? Wise has the edge because you can hold 50+ currencies in your account, and switch between them with the mid-market rate whenever you need to. You’ll instantly be able to generate and use up to 3 virtual debit cards which are compatible with Apple Pay, Google Pay and other mobile wallets for contactless spending, as well as online and in-app payments.

Open a personal Wise account online or in the handy Wise app, and order a physical debit card for a one time fee of 10 AUD. Convenience - Mastercard virtual debit card is ordered and received through My Fibank mobile application without the need to visit an office of the Bank. If you love to shop online with international retailers, or travel frequently for business or pleasure, the Wise virtual debit card could be the one for you.

#Virtual debit card windows#

Virtual cards through Google Pay are currently available in Chrome for desktop computers (Mac, Windows and Linux), Chrome for Android, and via merchant apps running in the. Your virtual debit card allows you to make purchases online or over the phone until you receive and activate your. You can find your GO2bank virtual debit card in the GO2bank app. This includes your debit card number, expiration date and CVV code. Eligible customers can also use virtual cards through Google Pay or via the Eno browser extension. A virtual debit card is all your debit card information without a physical, personalized card. Wise Virtual Debit Card - our pick for virtual debit card in Australia Virtual cards are not available for debit cards and some credit cards. Use your virtual debit card for online and in-app spending, or link it to a wallet like Google Pay or Apple Pay to spend in person when you’re out and about. That’s useful as an extra security measure when spending with new merchants - use your virtual card for a transaction and then block the card details afterwards, so you know they can’t be stolen or used inappropriately. Card details are different to your regular, physical card, but linked to the same account. You can usually generate virtual card details instantly and freeze or dispose of them just as easily. For example, providers like Wise and Revolut - which we’ll explore more later - offer multi-currency account access to spend with your virtual card in dozens of currencies with no foreign transaction fee. Virtual debit cards are often linked to smart online accounts which have their own features and selling points. A virtual debit card works much like a regular debit card - but instead of being a physical card, it exists only online and via your smartphone.

0 kommentar(er)

0 kommentar(er)